Cyprus, officially the Republic of Cyprus, is an island in the Eastern Mediterranean, east of Greece, south of Turkey, west of Syria and north of Egypt. It is the third largest island in the Mediterranean Sea and one of its most popular tourist destinations.

Cyprus is an independent and sovereign Republic based on the presidential system. Therefore, the executive power is exercised both by the President of the Republic and the Council of Ministers. The Legislative and the Judiciary authority are distinctively exercised by the House of Representatives and the High Court respectively.

Advantages of Buying Property in Cyprus:

- Non-EU residents who purchase property in Cyprus may obtain a Permanent Residence Permit under certain circumstances;

- Non-EU residents may follow a special investors’ scheme for obtaining a Cypriot Passport;

- Investing in property is more secure than investing, for instance, in the stock market;

- Investments under the crisis conditions are more beneficial for the buyers;

- There is a large rental market, making the property a good rental potential as well as a holiday or permanent residence.

Acquisition of Immovable Property by EU citizens:

After the accession of Cyprus in the European Union many regulations in relation to the restrictions of obtaining property in Cyprus have changed. More specifically, after the lapse of the transitional period of 5 years as agreed with the European Union, in order to protect Cyprus sensitive property market, citizens of the EU are now allowed to own as much immovable property in the island as they wish.

Acquisition of Immovable Property by Non-EU citizens:

Non-EU citizens who purchase property in Cyprus can benefit from the new and accelerated procedure for obtaining a Permanent Residence Permit.

The applicants must:

- Submit the application accompanied with a title deed or contract of sale (submitted to the Department of Lands and Surveys) for a property purchased in Cyprus of a minimum value of €300.000 and proof of payment for at least €200.000.

- Prove that they have at their disposal a minimum annual income of €30.000 transferred from overseas. The amount requirement increases by €5.000 for each dependant.

- Submit a letter from a Cyprus Financial Institution confirming they have deposited an amount of minimum €30.000, to be blocked in the account for 3 consecutive years. The amount should be sourced from overseas.

- Submit a clean criminal record certificate issued by the Authorities of their country of origin.

- Submit a statement confirming they will not be working or be engaged in any form of business in Cyprus.

- Visit Cyprus at least once every two years.

Provided that the criteria described above are fulfilled, the application shall be examined by the Minister of the Interior and the permit shall be granted within 2 months.

Cyprus Citisenship

Benefits:

- The Cyprus passport provides you all the advantages of being a European national, including among others, the right to free movement and residing within the European Union.

- The whole family, including one lawful wife and children up to 28 years of age which are financially depended on their parents are entitled to be added to the investor’s application without having to increase the amounts invested.

- The procedure is quick, whereas the application is processed within 6 months

What you need to know when buying property in Cyprus:

- Transfer Fees on Property in Cyprus (an expense payable by the Buyer):

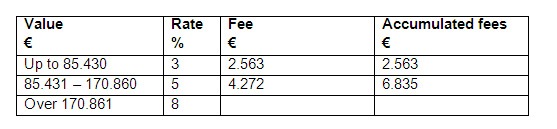

Property Transfer fees need to be paid on the resale of property, from the secondary market, and are calculated on the sliding scales as follows:

It is important to note that a 50% discount is applied on the payment of the transfer fees.

Property Transfer Fees are usually calculated on the market value of the property at of the date of purchase. However, if your Contract of Sale was not deposited at the District Lands’ Office, your Property Transfer Fees will be calculated on the assessed value of the property on the day the transfer takes place.

You can calculate your property transfer fees online by visiting the Cyprus Department of Lands and Surveys – Transfer Fees Calculator following the link:

http://www.moi.gov.cy/moi/dls/dls.nsf/dmltransfer_en?openform

Please note that the market value may not be the same as the price you paid for the property (sale price). At the Valuations Department of Land Registry Office, the transfer fees will be calculated according to the market value of the property in the area it is located.

- VAT on Property (an expense paid by the Seller):

Currently the VAT is charged on a property obtained from the primary market at the rate of 19%.

Reduced VAT rate of 5% on the purchase of a permanent residence with effect from 1st of October 2011

A reduced rate of VAT (5%) has been introduced for properties purchased by permanent residents of Cyprus, provided that the property will be used as the main residence of the purchaser for 10 years (minimum). This is applicable only to contracts of sale which are conducted from October 1st 2011 onwards. The rate will apply for the first 200 m2 of residences of total covered area of up to 275 m2.

- Stamp Duty (an expense paid by the Buyer):

Stamp duty in Cyprus is levied on ‘documents’ (i.e. written agreements/contracts) relating to assets located in Cyprus and/or matters taking place in Cyprus. Stamp duty is calculated on the value of the agreement at 0.15% for amounts exceeding €5.000 up to €170.000, and at 0.2% thereafter with a maximum payable capital of €20.000 per stamped agreement.

The person legally liable to pay the stamp duty (unless otherwise stated in the agreement) is the Buyer.

The stamp duty is payable within 30 days from the day of the ‘signing’ of a document which is considered to be subject to stamp duty when such document is signed within Cyprus. In the event where the deadline lapses without payment of stamp duty penalties are imposed.

The related penalties are depended on the amount of the contract and the time lapsed but in general, it is estimated at 10% for the first 6 months and approximately double the 10% charge, following the lapse of the first 6 months. This means that the maximum exposure on top of the maximum stamp duty cap of €20.000 is an additional penalty of not more than €4.000.

- Capital Gains Tax from sale of shares in property companies ( an expense paid by the Seller):

The disposal of immovable property situated in Cyprus as well as the disposal of shares of a company that directly / indirectly (through layers of companies) owns immovable property situated in Cyprus are subject to Capital Gains Tax (CGT) at the rate of 20%.

Capital Gains Tax imposed on property belonging by an individual:

Individuals may claim exemptions/deductions from the applicable taxable gain in the following situations:

- In the case of a disposal that relates to a main private residence used by the owner for at least five years, then under certain conditions the exemption is calculated up to €85 430,07 (£50 000);

- In the case of a disposal relating to agricultural land and is made by a farmer, the exemption is calculated up to €25 629.02 (£15 000);

- In the case of any other disposal, the exemption is calculated up to €17 086.01 (£10 000).

These exemptions/deductions are granted once in the lifetime of the individual until fully exhausted and if an individual claims a combination of them, the maximum deduction granted cannot exceed the €85 430,07 (£50 000).

Capital Gains Tax imposed on immovable property owned directly / indirectly by a Company:

In cases where immovable property is owned directly / indirectly by a Company, the relevant CGT charge of 20% will apply if the value of the immovable property situated in Cyprus represents more than 50% of the value of the assets of the Company.

Capital Gains Tax exemption

An exemption was introduced on the 16th of July 2015 that exempted those who purchased property between the period from the 16th of July 2015 until the 31st December 2016 of the payment of the 20% Capital Gains Tax. This exemption is applicable regardless of the date any possible future sale takes place.

- Annual Property Taxes:

A. Immovable Property Ownership Tax

Immovable Property Tax has been abolished as of the 1st of January 2017

Until the end of 2016, the registered owner of the property was liable to an annual Immovable Property Ownership tax calculated on the market value of the property as at 1st of January 1980, paid annually to the Inland Revenue Department.

B. Local Authority Fees

Depending on the size of your property, local authorities charge between €85 – €500 per annum for regular refuse collection, street lighting, sewerage and similar community services. Communal Services fees are payable to your local municipal authority.

C. Sewerage Tax

As the registered owner of the property, you are required to pay an annual Sewerage Tax, calculated on the market value of the property as at 1st of January 1980. Rates vary from 3‰ – 7‰. Sewerage taxes are payable annually to your local sewerage board.